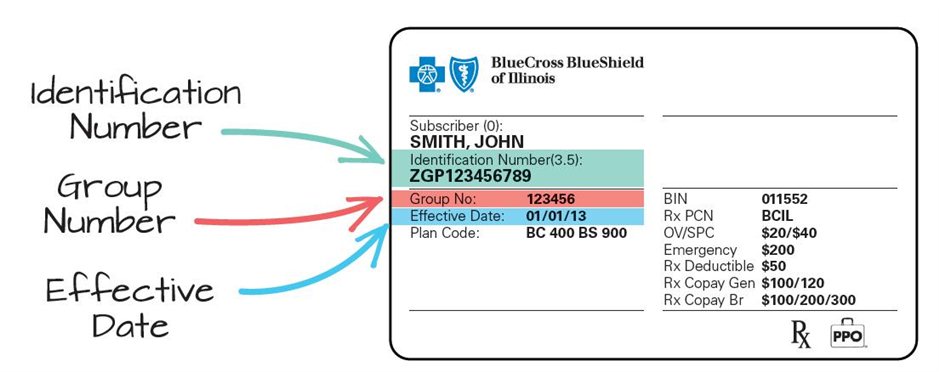

Need to know that your health insurance policy number is usually your member ID number. This number is typically located on your health insurance card, so it is easily accessible. Your health care provider will be able to use it to verify your eligibility and coverage. Also, you are able to provide this number to your health insurance company so they are able to look up your information when you have questions regarding your benefits and any recent claims. ASU Health Services is pleased to offer aBridge service discount programdesigned to save the student money if they need certain health services at the University. ASU Health Service's mission is to provide quality health care at low cost to the students at ASU.

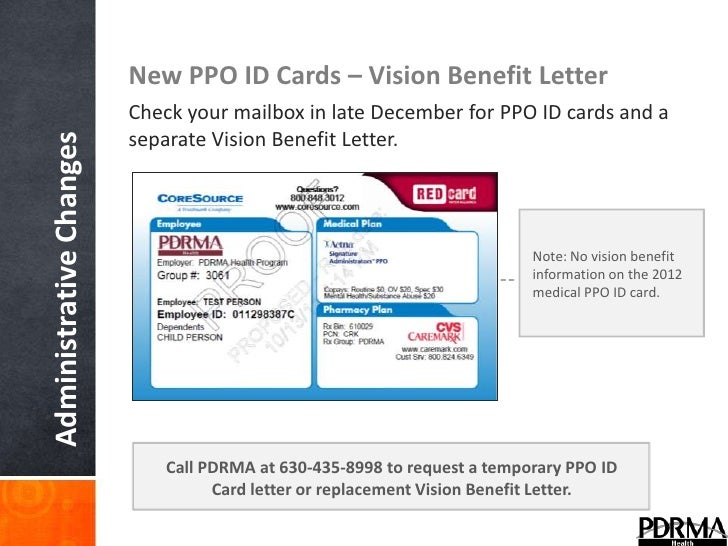

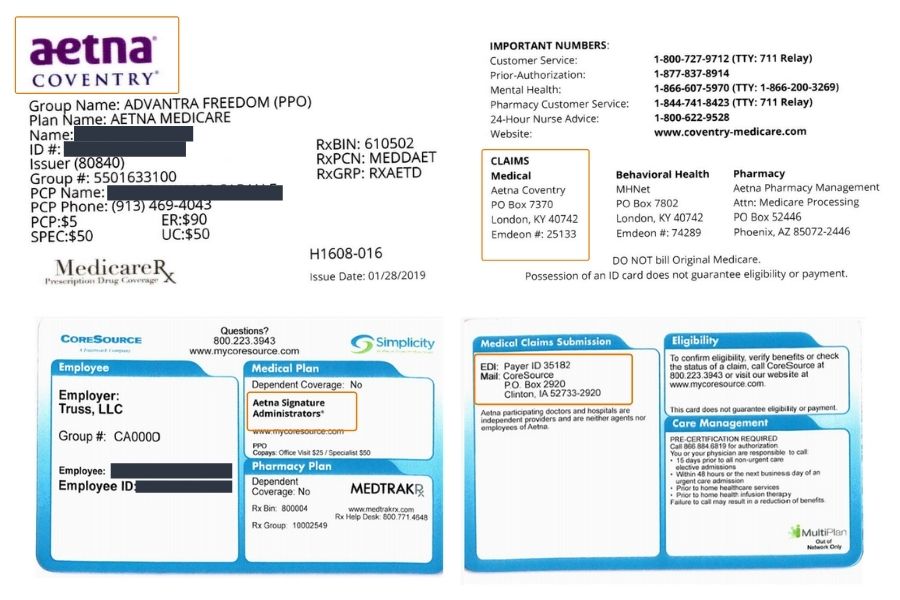

Even though you have health insurance, it may not cover everyday health expenses like preventive or routine visits, lab tests, x-rays or consultations with an on-campus specialist. Many of the insurance plans require a higher deductible, or no coverage when the student is "out of network". Aetna automatically issues health insurance cards for the 'default' health plan option (Aetna Choice plan at the 'employee-only' coverage tier) to new fully benefits-eligible employees.

If you elect another health plan option, you may disregard the Aetna Choice card. If you choose the Aetna Choice health plan option, keep the card for your use. Your health insurance policy number is typically your member ID number. This number is usually located on your health insurance card so it is easily accessible and your health care provider can use it to verify your coverage and eligibility.

Your health insurance policy number is usually your member ID number. Your health care provider will be able to use it to verify your coverage and eligibility. Student health insurance plans are underwritten by Aetna Life Insurance Company . Aetna Student HealthSM is the brand name for products and services provided by Aetna Life Insurance Company, Aetna Health and Life Insurance Company and their affiliated companies. Aetna Student Health administers the University of Virginia student health insurance plan.

Aetna Student Health has more than 30 years of experience in student health insurance. It employs more than 300 individuals focused on all aspects of student health insurance. Aetna Student Health partners with over 200 colleges and universities on a fully-insured basis and is the largest student health administrator in the country. It proudly points to the fact that they retain a majority of their college clients and enrolled students each academic year and that it insures more than 500,000 students and dependents nationwide. Aetna Student Health members are provided access to preferred providers through the nationwide Aetna network.

You can obtain services via the Cigna network if you or a covered family member need medical care while visiting the U.S. MIP participants who have selected Cigna International as their medical claims administrator have access to the Cigna Health Care OA Plus provider network in the U.S. While it is not mandatory to use a Cigna network provider, you are likely to pay more for your health care if you choose not to use a network provider and use a provider of your choice. While the vast majority of U.S. providers are paid directly by Cigna, you may need to submit claims for reimbursement from some providers to Cigna for processing. Refer to Medical Insurance Administrators, Switching between Cigna and Aetna - Change Insurance Administrators. If you do not see your coverage amounts and co-pays on your health insurance card, call your insurance company .

Ask what your coverage amounts and co-pays are, and find out if you have different amounts and co-pays for different doctors and other health care providers. Finally, you might see a dollar amount, such as $10 or $25. This is usually the amount of your co-payment, or "co-pay." A co-pay is a set amount you pay for a certain type of care or medicine. Some health insurance plans do not have co-pays, but many do. If you see several dollar amounts, they might be for different types of care, such as office visits, specialty care, urgent care, and emergency room care. If you see 2 different amounts, you might have different co-pays for doctors in your insurance company's network and outside the network.

Graduate students enrolled in 100% online programs do not have the option to elect the student health insurance plan. ID cards can be viewed and/or printed prior to their arrival in the mail after your health plan coverage selections have been processed. Once registered, you will have access to your ID card and claims information. In addition, you will have access to your plan-specific provider network. Students are required to either enroll in the UR Student Health Insurance Plan or waive this plan if their health insurance plan meets University Insurance Criteria. All full-time students must complete the Online Health Insurance Process every year to make the insurance selection.

Requests to waive the UR Student Health Insurance Plan may be audited to verify coverage. If the student's plan does not meet the requirements, the student will be automatically enrolled in the UR Student Health Insurance Plan . International-based insurance plans often do not meet University criteria. See "Insurance with an International-based Company" below for more information. A health insurance policy number identifies you as a unique member to your health insurance company.

Your insurance policy number is the key to obtaining treatment and ensuring that your healthcare provider can properly bill your insurer. You can normally find your policy number on your health insurance card. A health insurance policy number will identify you as a unique member to your health insurance company. Remember that your insurance policy number is the key to getting treatment and ensuring that your healthcare provider will be able to bill your insurer properly.

Usually, you are able to find your policy number on your health insurance card. Students may already have health insurance through their parents, or employer. If so, these students should carry their health insurance cards with them at all times.

ASU Health Service can/will file claims to third party insurance companies we are contracted with if the student presents the card at the time of visit. Because of this, if you're on a Medicare Advantage or prescription drug plan, you'll receive a different Medicare ID card than your Original Medicare or red, white, and blue card. MultiPlan does not offer insurance, does not administer benefit plans, and does not pay claims to the doctors or facilities in our network. If you need services during this time frame and prior to your benefit elections being processed, you may be asked to pay up-front for services.

This can be adjusted at a later date when the Third Party Administrator processes your benefits selections. If you need an appointment urgently and have selected your benefits but do not have your EHP ID card yet, you may ask the scheduler to select "EHP Pend" as your payer when scheduling the appointment. Your provider office can also call EHP to confirm coverage. Please note, if you are an Out-of-Area caregiver and need services prior to receiving your health plan ID card, you will have to pay upfront for services and then complete a reimbursement form. Coverage determinations are made on a case-by-case basis and are subject to all of the terms, conditions, limitations, and exclusions of the Member's contract, including medical necessity requirements. Health Net may use the Policies to determine whether, under the facts and circumstances of a particular case, the proposed procedure, drug, service, or supply is medically necessary.

The conclusion that a procedure, drug, service, or supply is medically necessary does not constitute coverage. The Member's contract defines which procedure, drug, service, or supply is covered, excluded, limited, or subject to dollar caps. The policy provides for clearly written, reasonable and current criteria that have been approved by Health Net's National Medical Advisory Council . The clinical criteria and medical policies provide guidelines for determining the medical necessity criteria for specific procedures, equipment and services. In order to be eligible, all services must be medically necessary and otherwise defined in the Member's benefits contract as described in this "Important Notice" disclaimer.

In all cases, final benefit determinations are based on the applicable contract language. To the extent there are any conflicts between medical policy guidelines and applicable contract language, the contract language prevails. Medical policy is not intended to override the policy that defines the Member's benefits, nor is it intended to dictate to providers how to practice medicine. As an Aetna Student Health Insurance member, you have access to Aetna Navigator, your secure member website, complete with personalized claims and health information.

Here you can view and print your ID card, view Explanation of Benefits, find participating providers and much more. Medicare Part C and Part D are health insurance plans regulated by the federal government that you can purchase through a private insurance company. People typically buy them because they cover services or medications that aren't covered by Original Medicare. If you withdraw from school within the first 31 days of a coverage period, you will not be covered under the Policy and the full premium will be refunded, less any claims paid.

If you withdraw from school for any reason other than joining the armed forces, Aetna won't refund your premium. Instead, you'll continue to be insured until your coverage period runs out for which premium has been paid. You will be insured for the coverage period for which you are enrolled, and for which premium has been paid.

Please refer to the Plan Design and Benefits Summary for more information regarding eligibility, coverage dates, premium rates and applicable deadlines. If applicable, a loss/end of coverage document will need to be obtained and uploaded regarding current insurance plan and submitted with request to add dependent. Through your health plan you have access to providers in our networks, but we do not administer your plan or maintain information regarding your insurance. For payment questions, including those about co-payments, deductible and premiums, you will need to contact your insurance company, human resources representative or health plan administrator directly.

If you lose your health insurance card with your policy and group number on it, it is important to contact your health insurance company right away and let them know. Call your insurance provider's customer service number and a representative should be able to help you. If you have family members listed as dependents on your health insurance plan, they may each have their own unique policy number as it is used for identification purposes and billing procedures.

Your health insurance policy number is what identifies you as a covered individual under your current or previous plans. It's important because if you change jobs or get married, divorced, etc., then your HIPN will need to match the new situation. If you move out of state, your HIPN needs to reflect where you live now. If you have health insurance through work, your insurance card probably has a group plan number. The insurance company uses this number to identify your employer's health insurance policy.

If you have health insurance through your job/work, then your insurance card may have a group plan number. Usually, the insurance company uses this number to signify your employer's health insurance policy. As an employee, you are covered by that health insurance policy. However, not all insurance cards have a group plan number.

It is very important because if you change jobs, get married, or divorced, then your health insurance policy number will need to match the new situation. If you move out of the state, your health insurance policy number needs to reflect where you live right now. All health insurance cards should have a policy number. When you get a health insurance policy, that policy has a number. On your card, it is often marked "Policy ID" or "Policy #." The insurance company uses this number to keep track of your medical bills. Insurance cards are available online to students who did not waive the school health insurance after the waiver deadline.

If you need an insurance card before the waiver deadline, you need to confirm your enrollment by going to haylor.com/FITand clickingFull-Time Waive and/or Enroll. Your enrollment will be processed and your insurance card will be available for download or print after 3-5 business days. When you are first enrolled in Medicaid or FAMIS, FAMIS MOMS, or Medicaid for children, you will get health care through fee-for-service. This means you can see any provider in the Medicaid or FAMIS fee-for-service network for covered services.

Before you make an appointment or fill a prescription, ask the doctor, clinic, hospital, dentist, pharmacy, or mental health provider if they accept Medicaid or FAMIS fee-for-service. There are no co-pays for FAMIS members in fee-for-service. You will not be allowed to disenroll from the insurance plan during the plan year unless you experience a qualifying life event (See "Changing Your Insurance Status During the Plan Year" below). Enrolling in this way (i.e., not completing the Online Health Insurance Process) is highly discouraged since it could lead to a delay in access to care during the first two months of the plan. Every year all full-time students, whether new or returning, must document their health insurance coverage by completing the Online Health Insurance Process during the appropriate open enrollment period. Students who enroll in the UR Student Health Insurance Plan are enrolled on the plan from August 1 through July 31 .

Students enrolling in UR Student Health Insurance Plan may enroll eligible dependents. Your health insurance company might pay for some or all the cost of prescription medicines. If so, you might see an Rx symbol on your health insurance card. But not all cards have this symbol, even if your health insurance pays for prescriptions. Sometimes, the Rx symbol has dollar or percent amounts next to it, showing what you or your insurance company will pay for prescriptions. You can also provide this number to your health insurance company so they can look up your information when you have questions about your benefits and any recent claims.

Each academic year to waive automatic enrollment in the student health insurance plan . RxGrp or prescription group is a set of alphanumeric or numeric numbers that pharmacies use to process your prescription benefits. For example, some insurers group the benefits based on physical benefits or pharmacy benefits, depending on your health care plan. The back or bottom of your health insurance card usually has contact information for the insurance company, such as a phone number, address, and website. This information is important when you need to check your benefits or get other information. For example, you might need to call to check your benefits for a certain treatment, send a letter to your insurance company, or find information on the website.

Student health insurance plan, but are not required to carry health insurance by the university. ASU Health Services now offers a discount program to pay for some of these services . It is a way to reduce your total health care costs for certain services rendered at any of the ASU Health Services locations. Once enrolled, you will be auto-enrolled for consecutive semesters in which you continue to be eligible. Please confirm your enrollment each semester by checking your ASU account for the student health insurance fee. Most Medicaid and FAMIS members get care through a health plan.

Each health plan has a network of primary care providers , specialists, hospitals, and other health care providers. Your new Medicare ID card should arrive in the mail in about 30 days. If, however, you need health care services or equipment sooner than that, you can request a temporary letter as proof of enrollment in Medicare. To get a temporary letter of proof, you'll need to visit your local Social Security Administration office in person.

Where Is The Group Name On Aetna Insurance Card However, you likely have access to MultiPlan's services through your health plan administrator or medical bill payor . Make sure to have your insurance ID card nearby, and refer to the information on this page to find a provider in your network. Once you have submitted your health plan coverage elections, it takes 4-6 weeks to receive your EHP cards. You need the cards to make medical appointments, get prescriptions, sign up for EHP wellness programs, or create an account on the Healthy Choice premium discount portal. You will be able to print your card and/or save it digitally. We recommend that you save your card on your mobile device.

The instructions on the site will tell how to download the Aetna mobile app to view your ID card on your mobile device. Insurance cards are no longer being mailed to students by Aetna Student Health. If you have coverage from an employer-based health insurance plan, there will most likely be a group number on your insurance card, as well. You might see another list with 2 different percent amounts. The "coverage amount" tells you how much of your treatment costs the insurance company will pay. This information might be on the front of your insurance card.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.